Stock Information

This page presents our policy on return to shareholders and other stock related information for investors.

NICIGAS’ Policy on Return to Shareholders

As of July 29th, 2021

NICIGAS focuses on Return to Shareholders and it is strengthening the returns with the cash generating from the initiative to shift asset to “high profit generating asset” such as LP Gas and ICT from “low profit generating asset” such as cash and head office, in order to enhance return on asset without expanding total asset size. In addition, under the continuous capital policy of “enhancing return to shareholders without holding unnecessary asset”, as well as maintaining 45-50% of capital-to-asset ratio, NICIGAS would increase dividend per share and repurchase of treasury stocks, responsively.

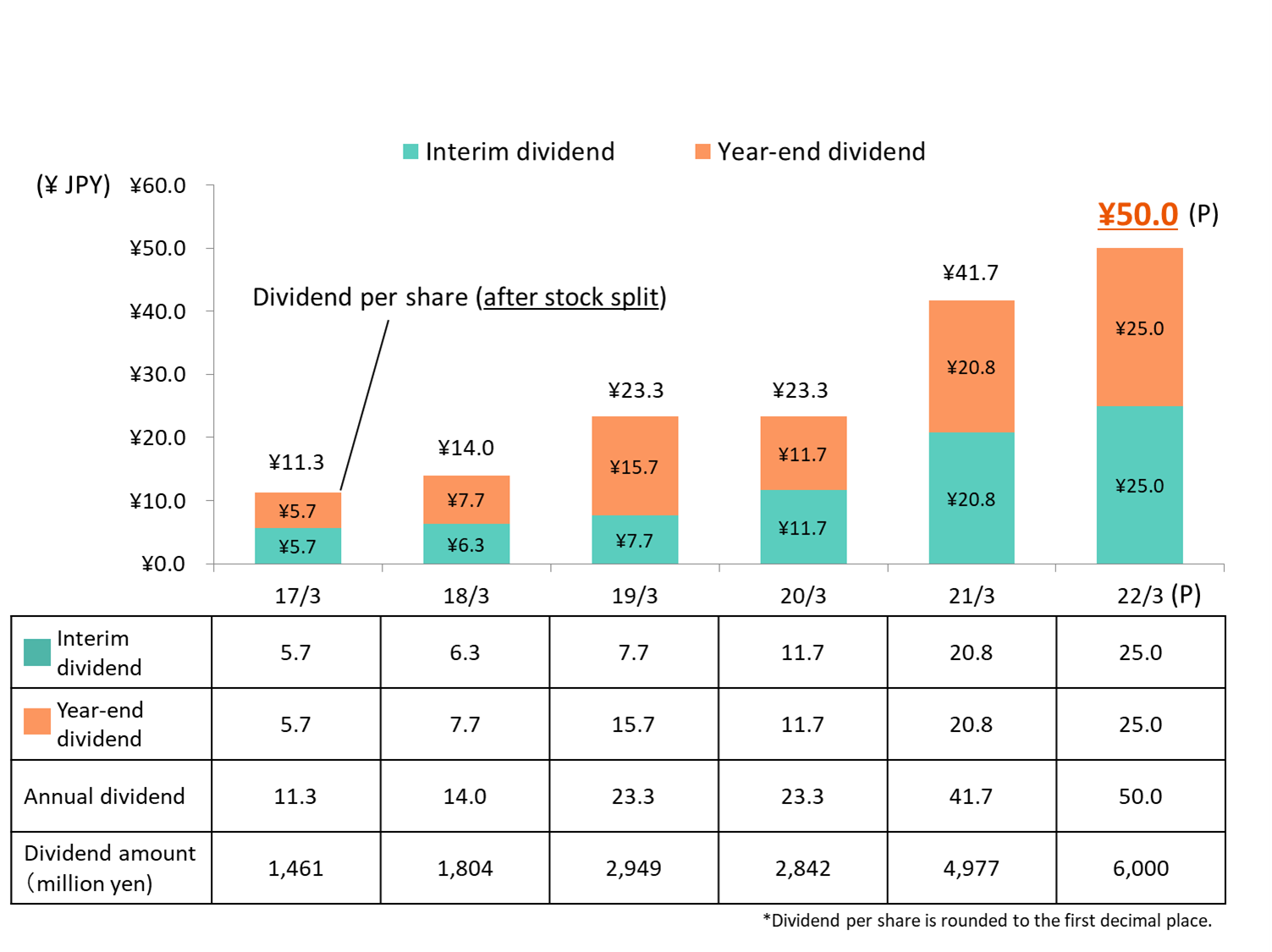

For the FYE 03/22, NICIGAS forecasts ¥10.0B of total shareholders return. The breakdown is 1) ¥6.0B of dividend (+¥1.0B YoY) and 2) up to ¥4.0B of repurchase of treasury stocks (+¥0.5B YoY). Dividend per share(*) will increase by ¥8.3 (YoY) to ¥50.0. With regards to the balance between dividend amount and that of repurchase of treasury stocks, NICIGAS will focus on dividend, based on the continuous profit growth. Total return ratio is forecasted to be 95% with the upward revision of Net Income forecast (¥10.0B→¥10.5B), announced on July 29th, 2021.

(*) After the stock split (NICIGAS split its ordinary share three-for-one on April 1st, 2021)

Trend of dividend (after stock split)

*Record date for interim dividends is September 30th and that for year-end dividends is March 31st, respectively.